Profit Margin Formula. Profit margin is a financial measure used to assess the profitability of a business or company. It represents the percentage of profit a company earns from its total revenue after deducting all expenses associated with the production and sale of goods or services.

Profit Margin Formula. Profit margin is a financial measure used to assess the profitability of a business or company. It represents the percentage of profit a company earns from its total revenue after deducting all expenses associated with the production and sale of goods or services.

Calculate profit margin

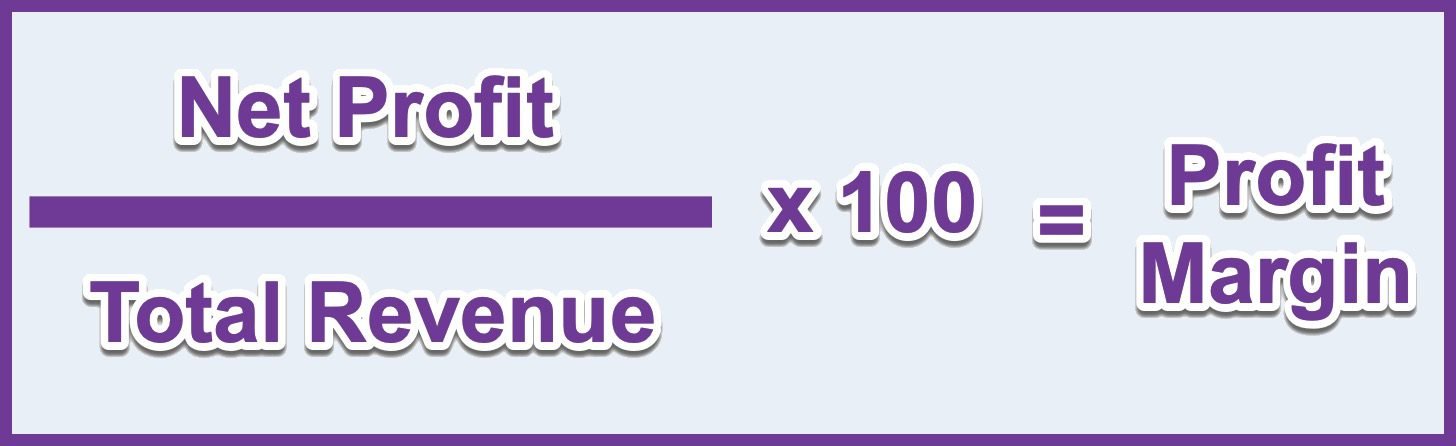

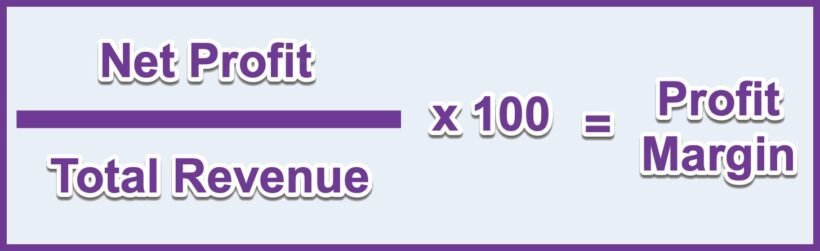

To calculate the profit margin on construction or installation projects, the revenue generated by the project is added up, and all associated costs are subtracted to determine the net profit. The profit margin formula is:

Net Profit Formula

Where:

– Net Profit refers to the total profit earned by the company after deducting all project-related expenses, such as labor costs, materials, equipment, subcontractor fees, Consumables, overhead costs, and any other project-specific expenses.

– Total Revenue represents the total amount of money received by the construction or assembly company from the client or the project sponsor for the completed work.

Key Considerations

It’s important to note that the profit margin in these works can vary significantly depending on various factors, including the type of project, size, complexity, geographic location, and competition within the industry.

To cover their operational costs, ensure financial stability, and invest in growth and expansion, construction companies typically aim to maintain a healthy profit margin.

Inefficiency, poor cost management, or intense competition can lead to low profit margins, while effective project management, cost control, and pricing strategies can lead to high profit margins.

Construction and, or assembly companies must be careful in estimating the project costs and pricing their services accurately to maintain a satisfactory profit margin while also remaining competitive in the market.

Monitoring and analyzing profit margins regularly can help these companies make informed decisions to improve their financial performance and overall profitability.

Exploring Profit Margin: A Tool for Your Business | Example

Suppose a company located in the vicinity of an oil region produces and sells the same type of pre-assembled Skid as the one shown in the following figure.

This company manufactures, moves and assembles the Skid on an existing foundation, it has the following financial balance:

Cost of manufacturing, transferring and assembling equal to $80,000.

Sale Price $100,000

Profit Margin 20%

The aforementioned company is invited to quote in another oil region, much further away from its factory and with higher assembly costs.

What is the new sale price if you want to maintain a 20% profit margin?

Financial balance

The cost of manufacturing, transfer, and assembly is equal to $90,000.

Profit Margin 20%

New selling price = $A.

Problem solved using formula

Profit Margin = (Net Profit / Total Revenue) x 100

replacing

20% = (A – $90,000/A) x 100,

if we clear we have that A = $112500

we check

PM = ($112,500 – $90,000/$112,500) x 100 = 20%

Maintaining the PM in this case implies increasing the sale price to $112,500.

Typical Profit – How to Calculate Profit Margin

Constructing and, or assembly projects typically have a percentage of benefits that is between 5 and 30%.

Commonly, high percentages are common in small and/or risky jobs.

The usual is:

- For small and/or difficult jobs, the margin to be charged is between 20 and 30%.

- On medium-sized jobs and with less risk, margins of 15 to 20% are common.

- From large and low-risk works, the margin is 10 to 15%.

- In very large and low-risk works, the margin is 5 to 10%.

Each company defines its percentage of profits or earnings according to:

- The stability of the currency in which we quote it.

- The profitability, which is the percentage of return on investment measured over time.

- Occupation of its operational capacity.

- The size and risk of the work.

- The intention to achieve continuity of work with that client, etc.

The profits earned by a company belong to its owners

In the execution of a project, each company puts into play his prestige, capacity, experience, capital, equipment, and other relevant factors.

The profits earned by a company belong to its owners, who are the shareholders or stakeholders in the business. After deducting all expenses, including operating costs, taxes, and interest, the remaining amount is the net profit. This net profit is essentially the company’s earnings or income.

In the case of a publicly traded company, the ownership is distributed among shareholders who hold shares of the company’s stock. The proportion of ownership that a shareholder has been determined by the number of shares they hold relative to the total number of outstanding shares.

When a company generates profits, it can do one of several things with the earnings:

- Distribute dividends: The company may decide to distribute a portion of its profits as dividends to its shareholders. Dividends are a way of sharing the company’s success and rewarding shareholders for their investment.

- Retain earnings: Instead of distributing all profits as dividends, the company might choose to retain a portion of the earnings to reinvest in the business for growth and expansion. These retained earnings can be used for research and development, capital investments, debt reduction, or other strategic initiatives.

- Buyback shares: The company can use its profits to buy back its own shares from the market. This reduces the number of outstanding shares and effectively increases the ownership stake of existing shareholders.

- Pay off debt: Profit can be used to pay down existing debts, reducing the company’s interest expenses and improving its financial health.

The decision on how to use the profits depends on the company’s financial goals, growth strategy, and the preferences of its management and board of directors.

Markup

Markup is the amount by which the cost of a budget is increased in order to obtain the selling price.

Determining the markup value in construction is a crucial aspect of pricing a project and ensuring that a construction company can cover its costs and generate a reasonable profit.

Markup Formula

We apply the markup to the quotation as follows:

As a percentage of the final cost of the estimate = Cost markup

Final price (no taxes) = cost + cost * (% cost markup)

If the cost is 1 and the markup 20% the price is 1.20.

As a percentage of its selling price = Mark-up on price

In this case we will obtain the final price as follows.

We denote the unknown final price as Pf.

Pf = cost + Pf *(% markup)

From the formula, we clear the final price (Pf) and we have:

Pf = cost / (1 – (% markup)

If the cost is 1 and the markup is 20%, the final price is 1.25.

Criteria to determine the Markup value

The margin that a company sets usually depends on:

- From the previous experience that each company has in the execution of similar works.

- The characteristics of the work.

- Project Size and Duration: The size and duration of the project can also impact the markup. Longer projects might require a higher markup to account for increased administrative and financing costs over time.

- The conditions of payment. If the construction company needs to secure financing or take loans for the project, the interest on the loans may need to be factored into the markup.

- Market Conditions: The level of competition in the construction industry and the current market conditions can influence the markup value. In highly competitive markets, companies might have to lower their markup to win contracts, while in less competitive markets, they may have more flexibility to set higher markups.

- The interest or need for the proponent to execute this work.

- Company Reputation and Expertise: Established and reputable construction companies with a track record of successful projects and specialized expertise may command higher markups compared to newer or less experienced firms.

- The risk that the bidder perceives as reasonable to assume. Projects that involve higher levels of risk, complexity, or uncertainty may warrant a higher markup to account for potential contingencies and challenges that could arise during construction.

It’s essential for construction companies to strike the right balance to remain competitive while ensuring profitability and sustainability in the long run.

In the next post Tax for Construction, Contractors, we summarize the type of taxes that will apply to tenders in the construction sector.

How to Calculate Profit Margin – Calculate Man Hours.