Piping Man-hours Estimation. Rough estimation of the order of magnitude (ROM) in the piping. In this post and the following, we will estimate the number of work hours required to assemble the welded piping as shown in the figure using three calculation methods.

Piping Man-hours Estimation. Rough estimation of the order of magnitude (ROM) in the piping. In this post and the following, we will estimate the number of work hours required to assemble the welded piping as shown in the figure using three calculation methods.

Gustavo Cinca

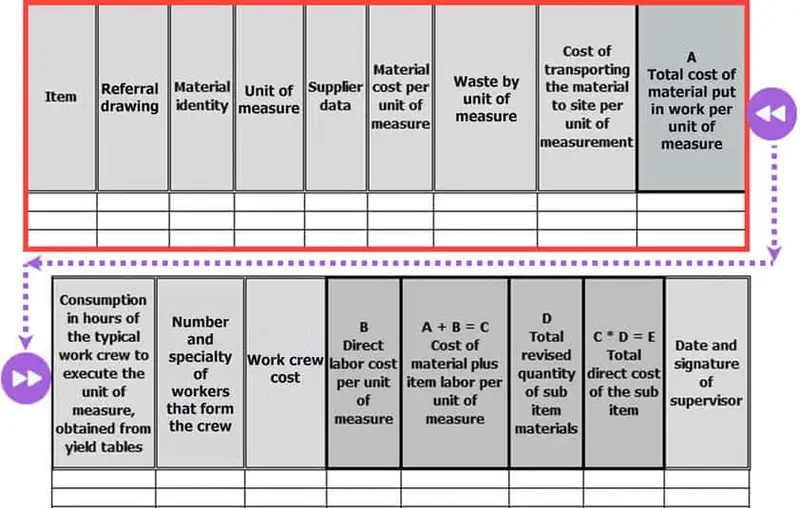

How to Calculate Direct Material Cost

How to calculate direct material costs with examples.

Steps to identify direct materials, inventory them, and assess costs, delivery times, and payment terms for effective procurement management.

Standard man hours for Civil works

Standard man-hours for construction works. Quickly calculate the man-hours required to complete reinforced concrete structures.

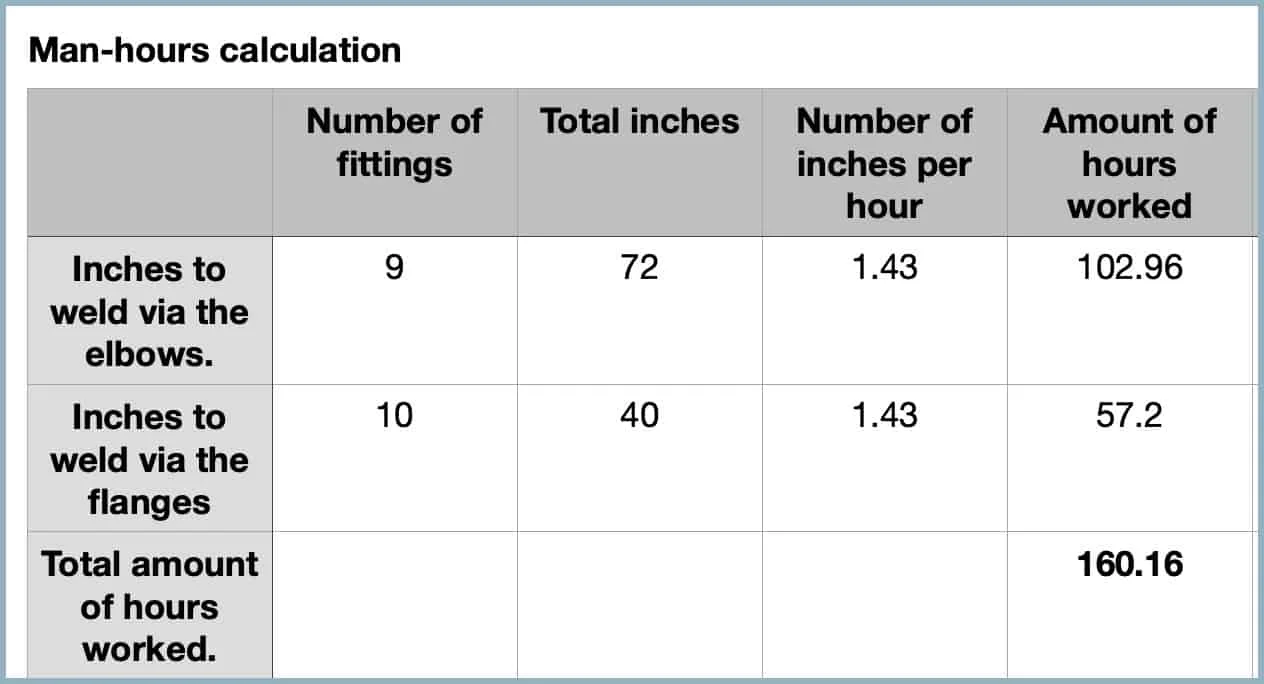

Man hours calculation

Calculate work hours. How do I calculate hours worked and overtime pay? A comprehensive guide to calculating hours worked on construction projects, including examples of overtime calculations. Tables for calculating hours worked on a construction project. Weekly hours’ calculator.

Profit Margin Formula

How to calculate the profit margin. To calculate profit margin, determine the percentage of profit from industrial operations after deducting all expenses, indicating overall profitability and efficiency.

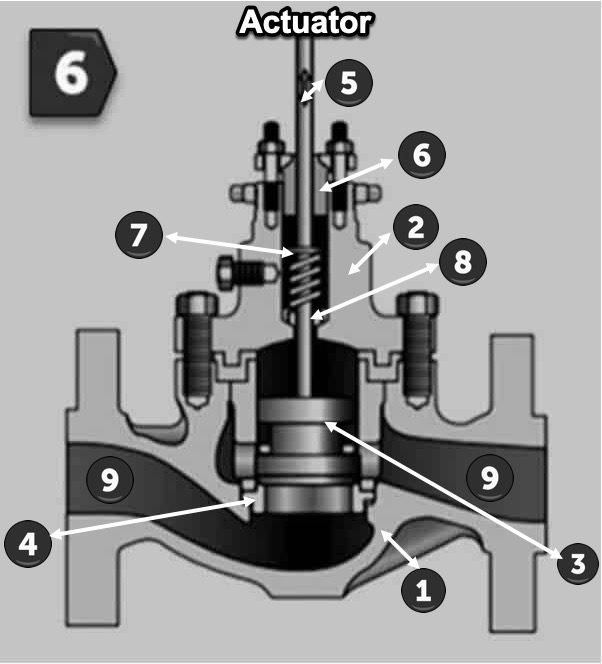

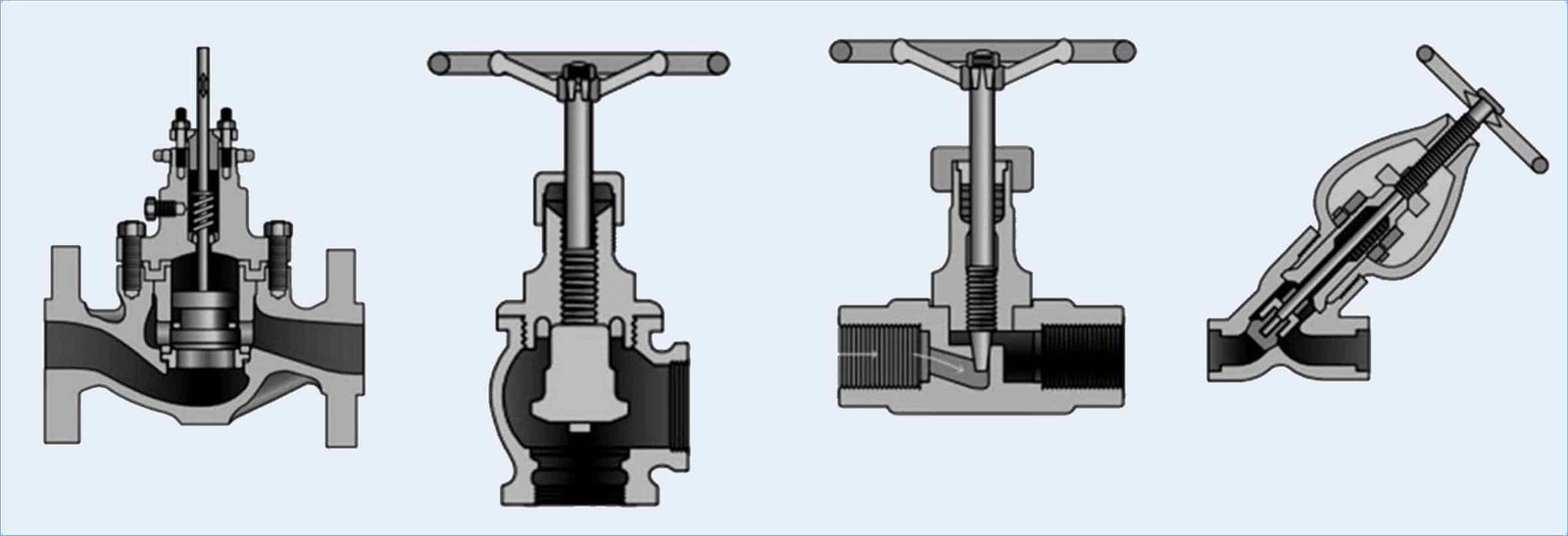

The Basics of Globe Valves: What You Need to Know

The Basics of Globe Valves: What You Need to Know. The term globe valve applies to a valve whose body is shaped like a globe or has characteristics like those of a globe.

The Basics of Globe Valves: What You Need to Know. The term globe valve applies to a valve whose body is shaped like a globe or has characteristics like those of a globe.

Globe valves are generally suitable for throttling applications, as the valve design determines how closely the flow can be regulated.

Working Time Calculation

Calculation of working time – Calculation of man hours. Calculate the man-hours required to build a reinforced concrete foundation.

In this example, we will calculate the man-hours required to construct a reinforced concrete foundation.

Cost per Hour for a Pickup Truck

Cost per hour of a pick-up truck. In this article we will complete the calculation of the hourly cost of the pickup from the previous article.

Cost per hour of a pick-up truck. In this article we will complete the calculation of the hourly cost of the pickup from the previous article.

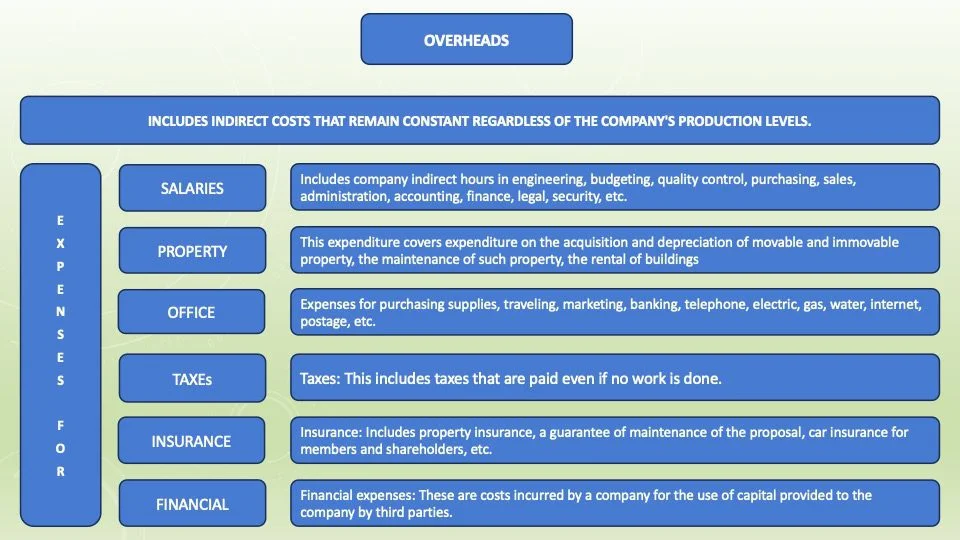

How to Calculate Overhead Costs

Overhead Calculation Guide: Discover effective methods to calculate and reduce overhead costs in construction projects, with comprehensive tips for accurate estimation.